Financial Wellness for Ultra-High-Net-Worth Women : Aura Solution Company Limited

WOMEN EMPOWERMENT

THE IMPORTANCE OF WOMEN IN FINANCE

At Aura Solution Company Limited, we recognize that women play a crucial role in shaping the future of the global economy. Empowering women in the workplace, particularly in finance, is not only a matter of equality—it is essential for driving innovation, growth, and long-term success. Aura is committed to fostering an inclusive environment where women can thrive, lead, and make a lasting impact in the financial sector.

The Power of Women in Finance

Women are increasingly influencing the world of finance, from managing investments and driving corporate strategies to leading companies and shaping economic policies. Research consistently shows that organizations with diverse leadership teams, including women in key decision-making roles, perform better financially and are more resilient in times of crisis. The presence of women in finance brings a fresh perspective, innovative ideas, and a collaborative approach to problem-solving, all of which are essential for success in today’s dynamic financial landscape.

Key Contributions of Women in Finance:

-

Diverse Perspectives: Women bring unique perspectives to the finance industry, contributing to more well-rounded and balanced decision-making processes. Diverse teams are better equipped to identify opportunities, mitigate risks, and adapt to changing market conditions.

-

Leadership and Innovation: Women in leadership positions drive innovation by challenging the status quo and encouraging new ways of thinking. Their ability to lead with empathy, collaboration, and strategic vision helps organizations navigate complexities and seize growth opportunities.

-

Building Trust and Relationships: Women are often recognized for their ability to build strong, trusting relationships with clients, colleagues, and stakeholders. This is particularly important in the finance industry, where trust is a key driver of success.

-

Advancing Social Responsibility: Women in finance are often champions of social responsibility, advocating for ethical practices, sustainability, and community engagement. Their leadership in this area helps organizations create long-term value while making a positive impact on society.

Aura’s Commitment to Women Empowerment

At Aura, we believe that empowering women is essential to achieving our mission of advancing sustainable economic growth and financial opportunity. Our commitment to gender diversity and inclusion is reflected in every aspect of our business, from recruitment and talent development to leadership and corporate culture. We are dedicated to creating a workplace where women are empowered to reach their full potential and contribute to the success of our clients and the communities we serve.

Key Initiatives to Empower Women at Aura:

-

Leadership Development Programs: Aura provides targeted leadership development programs designed to support the growth and advancement of women at all levels of the organization. These programs focus on building leadership skills, fostering mentorship, and creating opportunities for women to take on key roles within the company.

-

Mentorship and Networking: We understand the importance of mentorship and networking in supporting women’s career advancement. Aura offers formal and informal mentorship programs, connecting women with experienced leaders who provide guidance, support, and opportunities for professional growth.

-

Inclusive Workplace Culture: Aura is committed to fostering a culture of inclusion, where all employees feel valued, respected, and empowered. We actively promote gender equality and work to eliminate barriers that may prevent women from advancing in their careers. Our commitment to diversity extends beyond gender, embracing all forms of diversity as key drivers of innovation and success.

-

Flexible Work Arrangements: We recognize that flexibility is essential for enabling women to balance their professional and personal responsibilities. Aura offers flexible work arrangements, including remote work options and family-friendly policies, to support women at all stages of their careers.

-

Championing Women in Finance: Aura actively supports initiatives that promote gender diversity in the finance industry. We partner with organizations and networks dedicated to advancing women in finance, and we regularly participate in industry events that highlight the contributions of women in this field.

The Business Case for Gender Diversity

Gender diversity is not just a social or ethical issue—it is a business imperative. Studies show that companies with greater gender diversity are more profitable, innovative, and competitive. Gender-balanced teams are better at solving complex problems, identifying new opportunities, and creating value for shareholders. By empowering women, Aura is not only advancing equality but also strengthening our business and the financial industry as a whole.

Looking to the Future

At Aura, we believe that the future of finance is inclusive. We are committed to creating opportunities for women to lead, innovate, and excel in their careers, and to making gender diversity a cornerstone of our success. As we continue to grow and evolve, we will remain focused on empowering women and ensuring that they have a central role in shaping the future of finance.

Conclusion

Women empowerment and gender diversity are integral to Aura Solution Company Limited's mission of advancing sustainable economic growth and creating financial opportunity. We are proud to support and champion the role of women in finance, recognizing that their contributions are essential to driving innovation, enhancing performance, and building a more equitable and prosperous future for all.

INVEST DIFFERENTLY

In today's dynamic financial landscape, the need for tailored investment strategies has never been more critical. While traditional investment advice often takes a one-size-fits-all approach, women face unique financial challenges and opportunities that necessitate a different investment strategy. Understanding these differences can empower women to achieve greater financial security and success.

The Gender Pay Gap and Its Implications

One of the most significant reasons women need to invest differently is the persistent gender pay gap. On average, women earn about 82 cents for every dollar earned by men, which can lead to substantial disparities in lifetime earnings and savings. This gap means that women often have less money to invest, making it crucial to maximize the growth potential of their investments.

Longer Life Expectancy

Women tend to live longer than men, with an average life expectancy that is about five years longer. This increased longevity means women need to plan for a more extended retirement period, requiring a larger nest egg to maintain their standard of living. Investing strategically can help bridge this gap, ensuring that women do not outlive their savings.

Career Interruptions

Many women experience career interruptions due to caregiving responsibilities, whether for children, elderly parents, or other family members. These interruptions can result in lost income, reduced retirement savings, and lower Social Security benefits. A well-thought-out investment plan can help mitigate these financial setbacks, ensuring that women can recover more effectively from career breaks.

Risk Tolerance and Investment Preferences

Studies have shown that women generally have a different approach to risk compared to men. Women tend to be more risk-averse, preferring investments that offer stability and security over high-risk, high-reward opportunities. This conservative approach can be beneficial in preserving capital but may also limit growth potential. An investment strategy that balances risk and reward, aligning with individual comfort levels, can help women achieve their financial goals.

Financial Education and Confidence

Many women report lower levels of financial literacy and confidence in their investing abilities compared to men. This lack of confidence can lead to hesitation and inaction, preventing women from fully participating in the financial markets. Promoting financial education and confidence-building initiatives can empower women to take control of their financial futures and make informed investment decisions.

The Importance of Diversification

Diversification is a key principle in investing, and it is particularly crucial for women. By spreading investments across various asset classes, industries, and geographic regions, women can reduce risk and increase the likelihood of steady returns. Diversification can help protect against market volatility and economic downturns, providing a more stable financial foundation.

Tailored Financial Advice

Women benefit from personalized financial advice that takes into account their unique circumstances and goals. Financial advisors who understand the specific challenges women face can offer tailored strategies that address issues such as the gender pay gap, longer life expectancy, and career interruptions. This personalized approach can lead to more effective and efficient wealth management.

Investing is not a one-size-fits-all endeavor. Women face distinct financial challenges that require customized investment strategies to ensure long-term financial security and success. By addressing the gender pay gap, planning for longer life expectancies, managing career interruptions, understanding risk preferences, boosting financial literacy, and embracing diversification, women can take control of their financial destinies. At Aura Solution Company Limited, we are committed to providing women with the knowledge, tools, and support they need to invest wisely and achieve their financial goals.

Investing differently is not just a necessity; it is an opportunity for women to build a secure and prosperous future.

INVEST DIFFERENTLY

In an era where financial independence and security are paramount, women in finance have emerged as powerful forces, driving change and innovation. Whether you are a female entrepreneur, a businesswoman, or the owner or inheritor of wealth, strategic financial planning is essential to protect and grow your assets. At Aura Solution Company Limited, we understand the unique financial challenges and opportunities faced by women and are committed to helping you achieve your financial goals.

The Growing Influence of Women in Finance

Women are increasingly taking on significant roles in finance, from leading multinational corporations to launching successful startups. This growing influence underscores the importance of tailored financial strategies that address the distinct needs of women in various financial contexts. Whether navigating the complexities of business ownership or managing inherited wealth, women benefit from a comprehensive approach to financial planning.

Tailored Financial Planning for Female Entrepreneurs

For female entrepreneurs, effective financial planning is crucial to the success and sustainability of their businesses. This includes:

-

Budgeting and Cash Flow Management: Ensuring that your business has sufficient cash flow to meet its operational needs while also planning for future growth.

-

Investment Strategies: Identifying investment opportunities that align with your business goals and risk tolerance.

-

Risk Management: Implementing insurance and other risk mitigation strategies to protect your business from unforeseen events.

-

Retirement Planning: Establishing retirement plans that secure your financial future, even if your business is your primary asset.

-

Succession Planning: Preparing for the eventual transition of your business, whether through sale, succession, or inheritance.

Wealth Protection for Businesswomen

As a businesswoman, protecting your wealth requires a multifaceted approach:

-

Diversification: Spreading investments across various asset classes to reduce risk and increase potential returns.

-

Tax Planning: Implementing tax-efficient strategies to minimize liabilities and maximize savings.

-

Estate Planning: Ensuring that your wealth is preserved and transferred according to your wishes through wills, trusts, and other estate planning tools.

-

Philanthropy: Integrating charitable giving into your financial plan to support causes you are passionate about while also benefiting from tax advantages.

Managing Inherited Wealth

For women who inherit wealth, managing and growing these assets requires careful planning:

-

Assessment and Analysis: Conducting a thorough analysis of inherited assets to understand their value and potential.

-

Goal Setting: Defining short-term and long-term financial goals to guide investment and spending decisions.

-

Investment Management: Developing a diversified investment portfolio that aligns with your risk tolerance and financial objectives.

-

Financial Education: Enhancing your financial literacy to make informed decisions and confidently manage your wealth.

-

Advisory Support: Collaborating with financial advisors who understand your unique needs and can provide personalized guidance.

The Role of Financial Advisors

At Aura Solution Company Limited, our team of expert financial advisors is dedicated to supporting women in their financial journeys. We offer:

-

Personalized Financial Plans: Customized strategies that reflect your individual circumstances, goals, and preferences.

-

Ongoing Support and Monitoring: Regular reviews and adjustments to your financial plan to ensure it remains aligned with your evolving needs.

-

Educational Resources: Tools and resources to enhance your financial knowledge and confidence.

-

Holistic Approach: Comprehensive services that encompass all aspects of financial planning, from investments to estate planning.

Whether you are a female entrepreneur, a businesswoman, or an inheritor of wealth, strategic financial planning is essential to protect and grow your assets. At Aura Solution Company Limited, we are committed to empowering women to achieve financial independence and security through tailored financial strategies. By understanding and addressing the unique challenges faced by women in finance, we help you navigate the complexities of wealth management and build a secure and prosperous future.

Empower your financial journey with Aura Solution Company Limited, where we prioritize your financial success and well-being.

In an era where diversity and inclusion are at the forefront of societal discourse, initiatives like Women in Finance at the University of Birmingham shine brightly as beacons of progress. Established with a vision to foster gender diversity within the financial industry and provide a supportive network for aspiring professionals, this society is making waves in empowering students to realize their full potential and pursue successful careers in finance.

Engage, enlighten, empower – these three pillars form the foundation of Women in Finance. With a mission to engage a global network of aspiring students from diverse gender and degree backgrounds, the society opens its doors to anyone with an interest in finance. By providing support and guidance, they enlighten students about the vast opportunities within the financial sector and empower them to seize those opportunities, regardless of gender.

At the heart of Women in Finance is a commitment to promoting gender diversity and inclusivity within the financial industry. Recognizing the underrepresentation of women in finance and professional careers, the society aims to dismantle barriers and create pathways for women to excel. Through a range of initiatives and events, they strive to create a supportive environment where women can thrive and succeed.

One of the key objectives of Women in Finance is to provide employability support for students aspiring to pursue careers in finance. From networking events and workshops to mentorship programs and career fairs, the society equips its members with the skills, knowledge, and connections needed to navigate the competitive world of finance. By partnering with industry professionals and alumni, they offer invaluable insights and guidance to help students kickstart their careers.

But Women in Finance is not just about professional development – it's also about community building and empowerment. Through networking events, panel discussions, and social gatherings, members have the opportunity to connect with like-minded individuals, share experiences, and build lasting relationships. It's a space where women can uplift and support each other as they navigate their journeys in finance.

As we look towards the future, initiatives like Women in Finance are essential in driving positive change within the financial industry. By championing diversity, inclusivity, and empowerment, they are not only shaping the next generation of finance professionals but also reshaping the landscape of the industry itself. With their unwavering commitment and dedication, they are paving the way for a more equitable and inclusive future in finance.

In conclusion, Women in Finance at the University of Birmingham stands as a testament to the power of community, empowerment, and advocacy. Through their efforts, they are breaking down barriers, creating opportunities, and empowering women to thrive in finance and beyond. As they continue to inspire and uplift, they remind us all of the limitless potential that lies within each and every one of us.

WOMEN IN INVESTING

As the financial landscape evolves, so too does the role of women in wealth management. Gone are the days when women relied solely on others to manage their finances; today, they are increasingly taking control and making informed investment decisions. Yet, despite this growing trend, women continue to face unique challenges and barriers in the financial world.

At Aura Solution Company Limited, we believe it's time to reimagine wealth advice to better serve the needs and preferences of women investors. Our latest publication explores the shifting dynamics of women's wealth journeys and outlines strategies for wealth managers to effectively support women in achieving their financial goals.

Women's wealth is on the rise, and with it comes a desire for greater control and autonomy over financial decisions. However, many women express dissatisfaction with the current advice they receive from traditional wealth management firms. They value the importance of expert advice, yet often feel overlooked or underserved by the industry.

A recent study by Aura Solution Company Limited revealed the significant impact of women's investment decisions on global capital markets. If women invested at the same rate as men, there could be over $3.22 trillion of additional capital available for investment, with a substantial portion flowing into more responsible investing practices. This highlights the immense potential for wealth managers to tap into this market and tailor their services to meet the needs of female investors.

Understanding the differences in how men and women approach investing is crucial for wealth managers seeking to attract and retain female clients. Women tend to prioritize long-term financial goals and value transparency, communication, and trust in their relationships with financial advisors. They also place a strong emphasis on social and environmental impact, seeking investments that align with their values and beliefs.

With these insights in mind, we propose a reimagined wealth management value proposition designed specifically for women. This includes:

-

Personalized Financial Planning: Tailoring financial plans to align with women's unique life goals, priorities, and risk tolerance.

-

Transparent Communication: Providing clear and concise information about investment options, fees, and performance metrics to build trust and confidence.

-

Education and Empowerment: Offering educational resources and workshops to empower women to make informed financial decisions and take control of their financial futures.

-

Responsible Investing Options: Offering a range of socially responsible and sustainable investment opportunities that reflect women's values and contribute to positive societal impact.

By embracing these principles and adapting their approach to better meet the needs of female investors, wealth managers can unlock new opportunities for growth and foster stronger, more meaningful relationships with their clients. At Aura Solution Company Limited, we are committed to championing gender diversity and equality in the financial industry and helping women achieve financial independence and success. Together, let's reimagine wealth advice for a more inclusive and prosperous future.

WOMENS'S WEALTH

In today's ever-evolving financial landscape, the journey towards wealth is not a one-size-fits-all experience. Among the myriad of factors that influence individual financial paths, gender plays a significant role, shaping the unique journey of women's wealth. At Aura Solution Company Limited, we believe it's essential to delve deeper into these differences to better serve and support women in achieving their financial goals.

The journey of women's wealth is marked by distinct challenges, opportunities, and priorities that set it apart from men's wealth accumulation. Understanding these nuances is key to providing tailored solutions and empowering women to navigate their financial futures with confidence.

One of the primary factors that distinguish women's wealth journeys is their life trajectory. Women often face unique life events, such as career breaks for caregiving responsibilities, that can impact their earning potential and savings accumulation. These interruptions in employment can result in lower lifetime earnings and savings compared to their male counterparts, necessitating a different approach to financial planning and wealth management.

Furthermore, women tend to prioritize different financial goals and objectives than men. While both genders share common goals such as retirement planning and wealth preservation, women may also place a greater emphasis on factors such as education expenses for children, healthcare costs, and long-term care planning. Understanding these unique priorities is crucial for wealth managers seeking to tailor their services to meet the specific needs of female clients.

In addition to life trajectory and financial goals, women's investment behavior also differs from men's. Research has shown that women tend to be more risk-aware and value-focused in their investment decisions, preferring strategies that prioritize capital preservation and steady returns over high-risk, high-reward opportunities. This prudent approach to investing reflects women's desire for financial security and stability, underscoring the importance of offering personalized investment solutions that align with their risk tolerance and preferences.

Moreover, women place a strong emphasis on trust, transparency, and communication in their relationships with financial advisors. They value open dialogue, clear explanations, and honest feedback, seeking advisors who can provide guidance and support in a collaborative and respectful manner. Building trust and rapport with female clients is essential for wealth managers looking to establish long-lasting relationships and deliver value-added services that meet their evolving needs.

At Aura Solution Company Limited, we recognize the importance of understanding the unique journey of women's wealth and are committed to providing tailored solutions and support to empower women in achieving their financial goals. Through personalized financial planning, transparent communication, and a focus on trust and collaboration, we strive to create a supportive environment where women can thrive and succeed on their wealth journey.

In conclusion, the journey of women's wealth is characterized by distinct challenges, opportunities, and priorities that require a nuanced and tailored approach to financial planning and wealth management. By understanding these differences and adapting their services accordingly, wealth managers can better serve and support women in achieving financial independence and success. At Aura Solution Company Limited, we are dedicated to championing gender diversity and equality in the financial industry and helping women navigate their financial futures with confidence and clarity.

TRADITION

In today's evolving socio-economic landscape, the role of women as breadwinners within their families has significantly transformed. Gone are the days when financial responsibilities were solely attributed to men. Now, nearly one-third of women in heterosexual couples in the US are the primary earners, showcasing a profound shift in traditional gender roles. However, despite their growing financial clout, many women breadwinners find themselves less engaged in financial decision-making compared to their male counterparts. Why does this discrepancy persist, and how can it be addressed?

Understanding the Factors at Play

Several factors contribute to the lingering gap between women and men breadwinners in financial engagement. Historical societal norms often dictate that men are the primary decision-makers when it comes to finances, perpetuating a culture where women may feel less confident or empowered in managing money matters. Moreover, traditional gender roles can lead to unequal distribution of domestic responsibilities, leaving women with less time and energy to dedicate to financial planning.

Additionally, trust issues may arise within relationships, with some women feeling hesitant to assert their financial autonomy due to concerns about disrupting familial harmony or being perceived as domineering. Furthermore, the lack of representation of women in the financial sector and the dearth of tailored financial services catered to their unique needs may further deter women from taking an active role in managing their finances.

Empowering Women through Financial Participation

To address these challenges, fostering financial participation among women breadwinners is essential. Aura Solution Company Limited recognizes the importance of empowering women to take charge of their financial futures through education, support, and personalized solutions. By providing accessible resources and guidance, Aura Solution Company Limited aims to equip women with the knowledge and confidence to make informed financial decisions.

Comprehensive Planning for Long-Term Success

Comprehensive financial planning is key to ensuring the long-term financial well-being of women breadwinners and their families. Aura Solution Company Limited offers tailored financial planning services that take into account the unique goals, circumstances, and aspirations of women clients. From retirement planning to investment strategies, our experts work closely with women breadwinners to develop personalized financial roadmaps that align with their priorities and values.

Support from Financial Professionals

Seeking support from trusted financial professionals can make a significant difference in empowering women breadwinners to navigate complex financial landscapes. Aura Solution Company Limited's team of experienced advisors is committed to providing women with the guidance, support, and expertise needed to overcome financial challenges and achieve their goals. By fostering a collaborative and inclusive approach, we ensure that women feel heard, valued, and empowered throughout their financial journey.

Breaking Barriers, Embracing Equality

As society continues to progress towards gender equality, it is imperative to break down barriers that hinder women's financial empowerment. By challenging traditional norms, promoting financial participation, and providing tailored support, Aura Solution Company Limited strives to create a more inclusive and equitable financial landscape where women breadwinners can thrive. Together, let us embrace tradition, trust, and time as catalysts for change and empower women to embrace their financial clout with confidence and conviction.

WOMEN ON PURPOSE

In today's fast-paced world, many women find themselves juggling multiple roles and responsibilities, often feeling stretched thin as they strive to balance career, family, and personal pursuits. In the midst of this hectic lifestyle, it's easy to lose sight of what truly matters and drift away from living with intentionality. However, a growing number of women are reclaiming control of their lives, aligning their actions with their values, and forging paths of purpose and fulfillment. At Aura Solution Company Limited, we celebrate these women on purpose and recognize the profound impact they are making on their own lives and the world around them.

Values as Guiding Lights

At the heart of living with purpose is a clear understanding of one's values – the principles and beliefs that guide decision-making and shape priorities. For many women, defining their values is a transformative journey that requires introspection and self-discovery. Whether it's prioritizing family, pursuing meaningful work, or making a positive impact on society, understanding what truly matters lays the foundation for living a purpose-driven life.

Money as a Tool for Alignment

While money is often viewed as a means to an end, it can also be a powerful tool for living in alignment with one's values. Aura Solution Company Limited recognizes the importance of financial empowerment in helping women achieve their goals and aspirations. Through personalized financial planning and investment strategies, we support women in aligning their financial decisions with their values, enabling them to pursue their passions and live with intentionality.

The Pursuit of More Intentional Lives

Living with purpose is not just about setting lofty goals or achieving external success; it's about embracing authenticity, finding fulfillment in everyday moments, and making choices that resonate with one's true self. For women on purpose, this journey is marked by courage, resilience, and a commitment to growth. It's about stepping into their power, owning their narratives, and shaping their destinies on their own terms.

Supporting Women on Their Journey

Aura Solution Company Limited is dedicated to supporting women on their journey towards living more intentional lives. Through our comprehensive financial planning services, we empower women to take control of their finances, set meaningful goals, and create strategies for long-term success. Our team of experienced advisors understands the unique challenges and opportunities women face, and we are committed to providing personalized support and guidance every step of the way.

Celebrating Women's Empowerment

As we celebrate International Women's Day and honor the achievements of women around the world, let us also recognize the power of purpose in driving positive change. Whether it's breaking glass ceilings, advocating for equality, or pursuing passions with purpose, women continue to inspire and uplift those around them. At Aura Solution Company Limited, we stand in solidarity with women on purpose, championing their dreams, and supporting their journey towards greater fulfillment, success, and impact. Together, let us redefine success on our own terms and pave the way for a more purposeful and empowered future for all.

WOMEN'S WEALTH

Women's wealth journey is a distinctive and multifaceted path shaped by a myriad of factors, ranging from societal norms to personal experiences. As a leading financial institution, Aura Solution Company Limited understands the nuances of this journey and seeks to shed light on what sets it apart.

-

Unique Financial Challenges: Women often face unique financial challenges throughout their lives. Factors such as the gender pay gap, career interruptions due to caregiving responsibilities, and longer life expectancies contribute to differences in earning potential and retirement savings accumulation compared to men. Aura Solution Company Limited recognizes the importance of addressing these challenges and providing tailored financial solutions to support women in achieving their long-term financial goals.

-

Financial Decision-Making Dynamics: Research indicates that women tend to approach financial decision-making differently than men. Women may prioritize long-term financial security and seek out more conservative investment strategies. Additionally, studies show that women value holistic financial planning and are more likely to consider the impact of their financial decisions on their families and communities. Aura Solution Company Limited acknowledges the importance of understanding these unique perspectives and works closely with women clients to develop personalized financial plans that align with their values and goals.

-

Empowerment through Education: Education plays a crucial role in empowering women to take control of their financial futures. Aura Solution Company Limited is committed to providing accessible financial education resources and workshops tailored to the specific needs and interests of women. By equipping women with the knowledge and tools to make informed financial decisions, we empower them to navigate the complexities of wealth management with confidence and competence.

-

Building Supportive Networks: Women often benefit from building supportive networks of peers, mentors, and financial professionals who understand their unique needs and challenges. Aura Solution Company Limited fosters a collaborative and inclusive environment where women feel supported and valued throughout their wealth journey. Our team of experienced advisors is dedicated to providing personalized guidance and support, helping women navigate financial complexities and achieve their goals.

-

Embracing Diversity and Inclusion: Diversity and inclusion are integral to Aura Solution Company Limited's approach to wealth management. We recognize that women come from diverse backgrounds and experiences, each with their own unique financial goals and aspirations. By embracing diversity and inclusion, we ensure that our services are accessible and relevant to women from all walks of life, empowering them to thrive financially and achieve their full potential.

In conclusion, the journey of women's wealth is marked by unique challenges, perspectives, and opportunities. Aura Solution Company Limited is committed to understanding and addressing these nuances, providing tailored solutions, education, and support to empower women to navigate their financial journey with confidence and purpose. Together, let us celebrate the resilience, strength, and resilience of women as they chart their course towards financial success and security.

BLACK WOMENOMICS

The economic landscape is undergoing a significant transformation, with a growing recognition of the need to invest in underrepresented groups. Among these, Black women stand out as a demographic with immense potential yet historically underinvested in. Aura Solution Company Limited, a leading global financial advisory firm, has taken a pioneering step with its initiative, "Black Womenomics: Investing in the Underinvested," aiming to bridge this investment gap and drive sustainable economic growth.

The Economic Power of Black Women

Black women represent a powerful yet often overlooked economic force. In the United States alone, Black women control significant consumer spending and are increasingly influential in the entrepreneurial ecosystem. According to a 2020 report by McKinsey & Company, Black women are starting businesses at a rate faster than any other demographic. Despite this, they face substantial barriers in accessing capital, mentorship, and networking opportunities.

The Investment Gap

Historically, Black women have been underrepresented in investment portfolios and corporate leadership positions. This disparity is not only a social justice issue but also an economic inefficiency. The underinvestment in Black women results in missed opportunities for economic growth and innovation. A study by the Federal Reserve Bank of Kansas City highlighted that businesses owned by Black women receive less funding and are more likely to be denied loans compared to their white counterparts.

Aura Solution Company Limited's Commitment

Aura Solution Company Limited recognizes the untapped potential of Black women and is committed to addressing the investment gap through its "Black Womenomics" initiative. This program is designed to provide targeted financial support, resources, and mentorship to Black women entrepreneurs and professionals. The initiative encompasses several key components:

1. Access to Capital

Aura Solution Company Limited is creating dedicated investment funds aimed at providing seed capital, venture funding, and growth capital to businesses owned by Black women. By partnering with banks, venture capitalists, and philanthropic organizations, Aura aims to ensure that Black women have the financial resources necessary to start and scale their businesses.

2. Mentorship and Networking

Access to a robust network of mentors and industry leaders is crucial for entrepreneurial success. Aura Solution Company Limited is establishing a mentorship program that connects Black women with experienced professionals in their respective fields. This program will provide guidance, industry insights, and support to help navigate the challenges of entrepreneurship.

3. Educational Resources

Education is a powerful tool for empowerment. Aura is developing a suite of educational resources, including workshops, webinars, and online courses, focused on business management, financial literacy, and leadership development. These resources are designed to equip Black women with the skills and knowledge necessary to thrive in the business world.

Case Studies: Success Stories

The impact of investing in Black women can be seen in numerous success stories. For instance, businesses like The Lip Bar, founded by Melissa Butler, and Partake Foods, led by Denise Woodard, have not only achieved significant market success but have also created jobs and contributed to their communities. These examples highlight the potential for growth and innovation when Black women are given the necessary support and resources.

Conclusion

"Black Womenomics: Investing in the Underinvested" by Aura Solution Company Limited is more than just a financial initiative; it is a movement towards economic justice and inclusive growth. By addressing the historical underinvestment in Black women, Aura is not only unlocking potential but also paving the way for a more equitable and prosperous future. Investing in Black women is not just the right thing to do; it is a smart economic strategy that benefits everyone.

About Aura Solution Company Limited

Aura Solution Company Limited is a global financial advisory firm dedicated to providing innovative solutions and strategic advice to clients worldwide. With a commitment to social responsibility and economic inclusion, Aura is at the forefront of driving positive change in the financial industry.

By embracing the principles of Black Womenomics, Aura Solution Company Limited is setting a precedent for other financial institutions to follow, ensuring that the future of finance is inclusive, diverse, and equitable.

EMPOWERING WOMEN

FINANCIAL INDEPENDENCE

In today’s dynamic world, the role of women in the workplace has evolved from a supporting function to a driving force behind societal progress. As women take on leadership roles across industries, their influence extends beyond corporate boardrooms and into the fabric of society, impacting families, communities, and global economies.

At Aura, we believe that women are integral to the future of work and society. Their participation is not only about representation; it is about reshaping the very foundations of business and economic development. Women’s empowerment in the workplace leads to broader societal change, fostering inclusive growth and innovation that benefits everyone.

The Changing Landscape

Historically, the professional environment was dominated by men, with women often relegated to secondary roles. However, over the past few decades, we’ve witnessed a remarkable shift. Women are no longer just part of the workforce—they are entrepreneurs, executives, innovators, and decision-makers.

Today, women are leading major corporations, founding successful startups, and driving policy changes that prioritize equality and inclusivity. At Aura, we see this transformation as not only a success story but a critical component of a thriving economy. We support initiatives that promote gender parity in leadership roles, ensuring that women have equal opportunities to contribute their skills, vision, and creativity.

Financial Independence: A Cornerstone of Empowerment

One of the most powerful outcomes of women’s increasing role in the workplace is financial independence. Financial independence provides women with the freedom to make choices that benefit their careers, families, and personal lives. It also enables them to invest in education, healthcare, and other critical areas that uplift communities.

Aura is committed to supporting women’s financial growth by providing resources, mentorship, and platforms to help them succeed. Whether it’s through access to capital for female entrepreneurs, investment strategies tailored to women, or educational programs focused on financial literacy, Aura recognizes that empowering women financially is key to creating long-lasting societal change.

Women and Society: Catalysts for Change

The positive ripple effect of women’s empowerment in the workplace is undeniable. Women’s economic participation boosts household incomes, improves education outcomes for future generations, and fosters healthier communities. As women advance in their careers, they become role models, inspiring others to pursue their aspirations without limitations.

Moreover, research shows that companies with gender-diverse leadership teams outperform their peers in profitability, innovation, and employee satisfaction. At Aura, we advocate for greater gender diversity in the workplace, as it directly contributes to the overall success of businesses and, by extension, the broader economy.

Driving a New Era of Equality

At Aura, we are proud to contribute to the global movement advocating for women’s equality in the workplace. Our initiatives, such as the 25,000 Women Program, provide women worldwide with the skills and tools to succeed in business. By creating pathways for women to advance in their careers, we not only help them achieve financial independence but also contribute to building a more equitable world.

Conclusion

Women in the workplace are shaping the future of business and society. Their role as leaders, innovators, and decision-makers is pivotal in driving sustainable growth and financial independence. At Aura, we remain committed to creating environments where women can thrive professionally and personally, contributing to a more prosperous and inclusive world for all. As we look ahead, we see a future where women’s contributions in the workplace are not just celebrated but are a fundamental pillar of societal advancement.

Women in Finance: A Report by Aura

At Aura, we recognize that women are driving change and innovation in the financial sector at unprecedented levels. With 60% of our workforce being women, they play a pivotal role in managing and overseeing financial operations at every level. This report highlights the unique contributions of women in finance, how Aura fosters gender equality, and why creating an environment where women can thrive is essential for building a prosperous and equitable society.

Women in Finance: Breaking Barriers and Leading Change

For decades, the financial industry was male-dominated, but women have consistently challenged this status quo. Today, they are key players in shaping the future of finance, from managing portfolios to leading global economic strategies. At Aura, we are proud to say that women hold the majority of finance-related positions, a clear testament to their expertise, leadership, and strategic thinking. Women in finance at Aura are not only involved in day-to-day operations but are also instrumental in long-term financial planning, risk management, and investment strategy. Their unique perspectives and problem-solving abilities enhance the decision-making process, fostering a well-rounded approach to managing complex financial challenges. At Aura, we don't just view this as a gender equality issue—it's smart business.

Collaboration, Not Competition

One of the core values at Aura is teamwork, where no one is viewed as superior or inferior. Our approach to finance is rooted in collaboration. Women and men at Aura work side by side, each bringing their strengths to the table. This teamwork model ensures that diverse perspectives are heard, creating a balanced and inclusive environment where the best ideas rise to the top.

By valuing the input of all employees equally, Aura has created a workplace culture that encourages innovation and growth. Our teams, driven by women’s leadership, reflect the belief that true success in finance—and any industry—comes not from competition but from cooperation.

Aura’s Commitment to Financial Independence for Women

Aura’s vision for empowering women in finance goes beyond the workplace. We see financial independence for women as a powerful tool to drive societal change. Through various initiatives and mentorship programs, Aura is helping women in finance gain the skills, confidence, and opportunities to lead not just within the company but also in their communities.

We provide continuous learning and development programs tailored to our female staff to enhance their financial literacy, leadership abilities, and technical skills. By doing so, we equip them to break through the proverbial glass ceiling and take on senior roles in the financial world. We also actively promote policies that allow women to balance their professional responsibilities with their personal lives, ensuring they can thrive in both arenas.

Women’s Leadership at Aura: A Case for Diversity

Research consistently shows that gender-diverse teams outperform those that lack such diversity. Women bring distinct perspectives to financial management, often approaching problem-solving with different viewpoints than their male counterparts. At Aura, we leverage this diversity of thought as a strategic advantage. Our female employees lead by example, proving that gender should never be a barrier to success in finance. Women at Aura are involved in critical financial functions such as asset management, client relations, risk analysis, and investment strategies. This has resulted in improved efficiency, better decision-making, and more resilient financial operations for our clients.

Leading a Greater Society Through Financial Independence

Aura firmly believes that empowering women in finance is key to building a more inclusive and thriving society. When women achieve financial independence, the ripple effect is profound: they invest in education, healthcare, and the well-being of their families and communities. This has a direct and positive impact on economic growth and societal development. By fostering a supportive environment for women in finance, Aura is not only contributing to their personal success but also to the broader goal of creating a fair and sustainable world. Our initiatives, such as financial education programs for women globally, help extend these opportunities beyond our own workforce, encouraging women to take control of their financial futures.

Conclusion

At Aura, we view our 60% female finance workforce not as a statistic but as a driving force behind our success. The collaboration between men and women, founded on mutual respect and shared goals, creates an environment where everyone can thrive. Our commitment to gender equality and financial independence for women aligns with our broader mission to advance sustainable growth and build stronger communities worldwide. As women continue to take the lead in finance at Aura, we remain focused on creating opportunities that will further empower them, ultimately shaping a more equitable and prosperous future for all. Aura's initiative is simple yet profound: by supporting women in finance, we are contributing to the financial well-being of society as a whole.

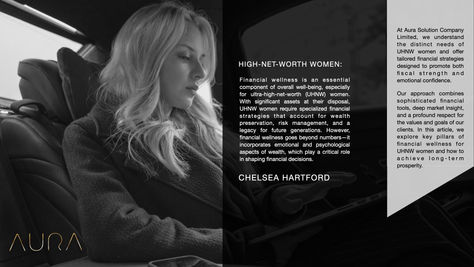

ULTRA HIGH NET-WORTH WOMEN

A HOLISTIC APPROACH

Financial wellness is an essential component of overall well-being, especially for ultra-high-net-worth (UHNW) women. With significant assets at their disposal, UHNW women require specialized financial strategies that account for wealth preservation, risk management, and a legacy for future generations. However, financial wellness goes beyond numbers—it incorporates emotional and psychological aspects of wealth, which play a critical role in shaping financial decisions.

At Aura Solution Company Limited, we understand the distinct needs of UHNW women and offer tailored financial strategies designed to promote both fiscal strength and emotional confidence. Our approach combines sophisticated financial tools, deep market insight, and a profound respect for the values and goals of our clients. In this article, we explore key pillars of financial wellness for UHNW women and how to achieve long-term prosperity.

1. Understanding Wealth Beyond Financials

For UHNW women, wealth is not merely a tool for personal luxury or security—it is often intertwined with family, community, and philanthropy. This dynamic necessitates a holistic approach to financial wellness, where emotional well-being, personal values, and social responsibilities are incorporated into the financial strategy.

Emotional Impact of Wealth: The responsibility of managing large sums of wealth can sometimes lead to stress or anxiety. For women with high public profiles or who have inherited wealth, the pressure to maintain or grow these assets can be significant. Financial wellness, therefore, requires not only optimizing investments but also addressing emotional well-being through trusted advisory relationships, financial education, and mentorship.

Aura's Approach: We provide bespoke financial planning that accounts for emotional stressors and the personal goals of UHNW women. Our advisors engage in in-depth discussions about life aspirations, ensuring that wealth management is not only about numbers but is also aligned with what brings satisfaction and fulfillment.

2. Tailored Investment Strategies

UHNW women typically seek investment strategies that are not only lucrative but also resonate with their personal beliefs. Environmental, Social, and Governance (ESG) investing, impact investing, and sustainable portfolios have become key interests among this group.

Diversification and Risk Management: UHNW women need to protect their assets from market volatility and geopolitical uncertainties while maintaining a growth trajectory. This requires an advanced understanding of global markets, opportunities for diversification, and strategies for risk mitigation.

Aura's Solution : Our investment advisory services are customized to match the individual risk tolerance, financial goals, and preferred time horizons of our clients. We focus on creating a diversified portfolio that incorporates alternative investments, private equity, real estate, and sustainable assets. These strategies ensure long-term wealth preservation and responsible wealth growth.

3. Philanthropy and Legacy Building

Many UHNW women are passionate about philanthropy and want to leave a lasting impact through charitable endeavors. Whether it's setting up family foundations, contributing to global causes, or influencing social change, philanthropy is often a key pillar of their financial vision.

Legacy Planning: Estate and legacy planning is crucial to ensure that the values and wealth of UHNW women are passed on to future generations. Inheritance laws, tax planning, and the selection of trustees or family offices require careful consideration.

Aura's Expertise: At Aura, we offer specialized legacy planning that ensures the efficient transfer of wealth while safeguarding family values. Our wealth planners work with tax specialists and legal experts to craft wills, trusts, and philanthropic vehicles that minimize tax burdens and ensure that the client’s wealth is distributed according to their wishes.

4. The Role of Education and Financial Independence

Financial literacy and independence are key components of financial wellness. For UHNW women, having a deep understanding of financial mechanisms, tax implications, and investment opportunities empowers them to make informed decisions. This education also facilitates confidence, helping them avoid common pitfalls such as over-reliance on advisors or a lack of transparency in financial management.

Next-Generation Education: Educating the next generation on wealth management is equally important, as it ensures that they are prepared to take on the responsibility of managing family wealth. This education goes beyond just financial knowledge; it also includes imparting values such as humility, responsibility, and generosity.

Aura's Role in Education: We offer comprehensive educational programs for our UHNW clients and their families, focusing on financial management, investment strategies, and the practical aspects of wealth stewardship. Through seminars, personalized sessions, and financial coaching, we ensure that every family member feels confident in their financial journey.

5. Health and Wellness Integration

As financial wellness is intrinsically tied to overall wellness, UHNW women are increasingly seeking advice on how to integrate their financial well-being with their physical, mental, and emotional health.

Wellness for the Whole Self: Financial security provides UHNW women with the freedom to invest in health and wellness, from preventive healthcare to mental health services. However, it’s also essential to strike a balance between managing wealth and maintaining personal health, avoiding burnout or stress from wealth-related responsibilities.

Aura's Holistic Services: Our approach incorporates wellness as part of the broader financial strategy. We collaborate with health experts to design programs that balance financial management with self-care, allowing UHNW women to enjoy the benefits of their wealth without compromising their health.

Financial wellness for ultra-high-net-worth women is a dynamic, multi-faceted journey that requires more than just sound investments—it requires a holistic, personalized approach that aligns with their emotional, social, and personal values. At Aura Solution Company Limited, we take pride in guiding UHNW women through this journey, empowering them to take control of their financial futures with confidence, purpose, and peace of mind.

By focusing on comprehensive wealth management, legacy planning, and wellness integration, we ensure that our clients not only preserve their wealth but also lead fulfilling, purpose-driven lives. Financial wellness is vital to human wellbeing. Our white paper explores its significance for ultra-high-net-worth individuals, and particularly the women who are leading a revolution in wealth globally.

Wealth ownership is undergoing a worldwide transformation. For most of history, men have owned and controlled the lion’s share of wealth.

Now, though, that is changing. Women are generating and overseeing wealth at unprecedented rates. Flourishing female entrepreneurship, successful corporate careers, and inheritance are among the factors at work here. For example, we believe women may receive a substantial majority of the $100 trillion wealth transfer from the baby boom generation that is currently underway.

1 .While potentially offering many benefits, this revolution also creates challenges for the new owners of wealth. These include pursuing and sustaining financial wellness.

Our new paper addresses this challenge from the perspective of ultra-high-net-worth individuals and particularly for members of our Women in Wealth community.

What is financial wellness?

Financial wellness is an evidence-based understanding that present and future financial needs can be met. Of course, everyone has their own set of needs.

For ultra-high-net-worth individuals, these may typically include:

-

Maintaining an accustomed standard of living

-

Putting in place health, life and disability insurance

-

Meeting education costs for successor generations

-

Having the wherewithal to deal with large, unforeseen expenses

-

Supporting cherished philanthropic causes

-

Funding passions and interests that fuel self-fulfillment

-

Securing the ability to make gifts and transfer wealth to beneficiaries

There is often an assumption that ultra-high-net-worth individuals must be financially well by default, given the scale of their income and assets. In fact, members of this community can succumb to financial unwellness just like anyone else. Financial unwellness is a state of anxiety that stems from the knowledge that personal finances are neglected and/or in poor shape.

The reasons leading to financial unwellness are typically the same for everyone, including excessive spending, poor investment habits, and overborrowing. Inadequate wealth planning and failure to prepare successors for their responsibilities are also factors.

Why financial wellness for dynamic women?

Financial wellness is vital. Those who are financially well are likelier to feel happier and fulfilled in other dimensions, such as their family life, social activities and professional endeavors. The principles and behaviors that contribute to financial wellness are applicable to all. Nevertheless, we have focused on women in this paper owing to the rapid rise of female wealth creation and ownership. Also, the financial industry historically focused its attention on men, which has created deficits in levels of confidence.

Overall, we believe a greater focus on financial wellness is needed in societies everywhere for all genders.

What determines financial wellness?

In this paper, we propose four pillars of financial wellness for the ultra-high-net-worth community. They are developing financial literacy, building a core investment portfolio, strategic borrowing, and comprehensive wealth and legacy planning. We explore the mindset and behaviors associated with these pillars, as well as some of the ways that our organization can assist. Importantly, we argue that financial wellness cannot simply be outsourced. Like good physical health, financial wellness is intensely personal, albeit with professionals providing support and guidance.

We conclude this paper with some questions that each of us should ask ourselves regularly.If you would like to discuss your financial wellness, we would be delighted to hear from you.Feel free to write us : info@aura.co.th

DAUGHTERS IN FINANCE

In an evolving world where equality and empowerment are gaining the spotlight, the role of women, particularly daughters, in finance is becoming increasingly significant. Aura Solution Company Limited is at the forefront of this change, advocating for the recognition and empowerment of women in finance. We believe that daughters possess unique capabilities that not only rival their male counterparts but often surpass them in focus, determination, and vision. By empowering daughters, we are not just fostering individual success but also shaping the future of our families, societies, and global economy.

Breaking the Stereotypes

Historically, the finance sector has been predominantly male, with women often relegated to supporting roles. This narrative is rapidly changing. More women are entering the finance industry, armed with education, skills, and an unwavering resolve to succeed. Research indicates that women excel in financial management due to their meticulous nature, analytical skills, and propensity for risk assessment and mitigation. These attributes make them invaluable assets in any financial institution.

Women as Family and Societal Architects

Women have always been the silent architects behind successful families and societies. Their innate ability to manage household finances with precision translates effectively into professional financial management. Women are natural savers and planners, ensuring financial stability and growth within families. This capability extends beyond the home, influencing community and societal development.

Leadership in Finance

Today’s daughters are tomorrow’s leaders. They bring innovative solutions and fresh perspectives to the financial sector. Studies show that companies with women in leadership roles often perform better, demonstrating higher profitability and better governance. Women leaders are more inclined towards ethical practices and inclusivity, fostering environments that encourage sustainable growth and collaboration. Their empathetic approach to leadership and decision-making balances risk and reward effectively, making them adept at navigating the complexities of the financial world.

Creating a Legacy of Empowerment

Empowering daughters in finance is not just about providing opportunities; it is about creating a legacy of empowerment and equality. By investing in the education and professional development of daughters, we are paving the way for a future where women contribute equally to economic growth and societal advancement. This empowerment is essential for building healthier families, stronger communities, and more prosperous nations. Saving and supporting daughters is not merely a moral obligation but an economic necessity.

Reshaping the World

Women have the potential to reshape the world in ways that are profound and far-reaching. From leading multinational corporations to driving social change, their impact is undeniable. In finance, women are breaking barriers and challenging stereotypes, proving their capability in managing complex financial portfolios and making strategic decisions. Their balanced approach, combining empathy with strategic thinking, positions them uniquely to address the challenges of the modern financial landscape.

Aura Solution Company Limited's Commitment

At Aura Solution Company Limited, we are committed to championing the cause of empowering daughters in finance. We recognize their invaluable contributions and strive to provide them with the opportunities and support they need to excel. By fostering an environment of equality and inclusivity, we aim to harness the full potential of our daughters, enabling them to lead and innovate.

Conclusion

Empowering daughters in finance is about more than just gender equality; it is about recognizing and nurturing the unique talents and perspectives they bring. By supporting their growth and aspirations, we are investing in a brighter, more inclusive future for everyone. Aura Solution Company Limited is proud to be part of this transformative journey, advocating for the empowerment of daughters who will shape the world of finance and beyond. Let us celebrate their achievements, support their endeavors, and work together to create a legacy of empowerment and success.

In summary, the empowerment of daughters in finance is a crucial step towards achieving a balanced and prosperous society. Women have always been the backbone of families and communities, and their role in finance is becoming increasingly pivotal. At Aura Solution Company Limited, we are dedicated to supporting and empowering daughters, recognizing their potential to lead and transform the financial landscape. Together, we can build a future where daughters are not just participants but leaders in shaping the world.

"Empowering Generations: How Aura Solution Company Limited Transformed the Financial Landscape for Black Women"

In 1990, Aura Solution Company Limited embarked on a pioneering mission to transform the financial landscape for black women. Recognizing the systemic barriers and unique challenges faced by black women in finance, Aura introduced a comprehensive support program aimed at fostering financial independence, professional growth, and social empowerment. Over the past 34 years, Aura's initiatives have not only empowered thousands of black women but have also created a ripple effect of positive change in communities and economies worldwide.

Empowering Through Education and Training

Aura's journey began with a clear vision: to provide black women with the tools, knowledge, and confidence needed to thrive in the financial industry. Through a combination of financial literacy workshops, business development training, and personalized mentorship, Aura equipped participants with the skills necessary to navigate and succeed in a predominantly male-dominated field. By addressing key areas such as budgeting, investing, credit management, and entrepreneurship, Aura's programs laid a solid foundation for financial competence and independence.

Mentorship and Networking: Building a Supportive Community

A critical component of Aura's success has been the creation of robust mentorship and networking opportunities. Participants were paired with seasoned mentors from the financial sector who provided invaluable guidance, support, and industry insights. These relationships not only helped mentees overcome professional obstacles but also fostered a sense of community and belonging. Through networking events, industry conferences, and online forums, Aura facilitated connections that opened doors to new opportunities and collaborations.

Overcoming Barriers and Achieving Success

The impact of Aura's initiatives is evident in the remarkable success stories of its participants. By addressing systemic barriers such as limited access to financial resources, discrimination, and lack of professional networks, Aura enabled black women to achieve significant milestones in their careers and businesses. Many participants have gone on to launch successful enterprises, secure leadership positions, and contribute to their communities' economic development. The confidence and skills gained through Aura's programs have empowered these women to become trailblazers and role models in the financial sector.

Community and Family Transformation

The benefits of Aura's support extend beyond individual success, positively affecting families and communities. Financial empowerment has led to improved living standards, better educational opportunities for children, and enhanced overall family stability. The economic contributions of these women have spurred job creation, local business growth, and community development. By inspiring others and giving back through mentorship and community projects, Aura's participants have become catalysts for broader societal change.

Global Recognition and Future Aspirations

Aura's innovative approach and impactful programs have garnered international recognition. Awards, partnerships with global organizations, and media coverage have highlighted the significant strides made in promoting financial inclusion and empowerment for black women. Looking ahead, Aura aims to expand its reach, integrate advanced financial technologies, and develop new initiatives tailored to emerging industries and global markets.

Aura Solution Company Limited's 34-year journey of supporting black women in finance stands as a testament to the transformative power of education, mentorship, and community. By breaking down barriers and creating opportunities, Aura has not only empowered individuals but has also fostered lasting positive change in families and communities. As Aura continues to build on this legacy, the future holds even greater promise for black women in finance, ensuring that financial independence and social empowerment remain attainable goals for generations to come.

HISTORICAL CONTEXT AND INITIATIVES

Q1: What was the primary motivation for Aura Solution Company Limited to start supporting black women in finance in 1990?

A1: Aura Solution Company Limited recognized a significant gap in financial opportunities and support for black women, which motivated them to initiate programs aimed at fostering financial independence and social empowerment for this underserved group.

Q2: How did Aura identify black women as a group needing specific financial support in 1990?

A2: Aura conducted extensive research and community outreach, revealing that black women faced systemic barriers to financial resources and professional development. This data highlighted the need for targeted support to help overcome these challenges.

Q3: What specific programs did Aura implement to support black women in finance initially?

A3: Aura implemented financial literacy workshops, business development training, mentorship programs, and access to microloans to support black women in achieving financial independence and starting their own businesses.

Q4: Who were some of the key figures within Aura advocating for these initiatives?

A4: Key figures included senior executives and board members who were passionate about diversity and inclusion, as well as community leaders who collaborated with Aura to tailor the programs to the specific needs of black women.

Q5: What challenges did Aura face in the early stages of implementing these programs?

A5: Aura faced challenges such as skepticism from the community, securing funding for the programs, and addressing the deep-seated issues of discrimination and bias that black women faced in the financial sector.

PROGRAM DETAILS AND IMPLEMENTATION

Q6: What types of financial training were provided to black women in the 1990s?

A6: Training included budgeting, saving, investment strategies, credit management, and entrepreneurship skills to equip women with the knowledge needed to manage their finances effectively and start their own businesses.

Q7: How did Aura Solution Company Limited select participants for their initial programs?

A7: Participants were selected through a combination of community outreach, applications, and referrals from local organizations and community leaders who identified women with the potential to benefit from the programs.

Q8: Were there any partnerships with other organizations to support these initiatives?

A8: Yes, Aura partnered with local non-profits, educational institutions, and financial organizations to provide comprehensive support and resources to the participants.

Q9: How did Aura ensure the sustainability of the programs for black women in finance?

A9: Aura focused on creating self-sustaining models by training trainers from within the community, establishing alumni networks, and securing ongoing funding and support from corporate and philanthropic partners.

Q10: What metrics did Aura use to measure the success of their programs?

A10: Metrics included the number of businesses started, financial literacy improvements, income growth, loan repayment rates, and qualitative feedback from participants on their personal and professional growth.

PERSONAL STORIES AND TRANSFORMATIONS

Q11: Can you share some personal success stories of black women who benefited from Aura’s programs?

A11: One participant, Angela, started a successful catering business after completing Aura's training. She now employs ten people and supports her community by providing mentorship to other aspiring entrepreneurs.

Q12: How did participating in Aura's programs impact these women's personal and professional lives?

A12: Many women reported increased confidence, improved financial stability, and the ability to provide better opportunities for their children. Professionally, they gained skills that allowed them to secure better jobs or successfully run their own businesses.

Q13: What changes did these women experience in their financial independence after participating in the programs?

A13: Participants experienced significant improvements in financial independence, with many able to save more, invest in their futures, and reduce their reliance on external financial support.

Q14: How did Aura’s support help these women in starting their own businesses?

A14: Aura provided business planning workshops, access to seed funding, and ongoing mentorship, which helped participants turn their business ideas into reality and navigate the challenges of entrepreneurship.

Q15: How has the support from Aura impacted the families of these women?

A15: The support from Aura enabled women to contribute more significantly to their household incomes, provide better educational opportunities for their children, and serve as role models for financial independence within their families.

ECONOMIC AND SOCIAL IMPACT

Q16: What economic changes were observed in communities where Aura's programs were implemented?

A16:Communities saw increased economic activity due to new businesses, job creation, and higher income levels among participants. This contributed to local economic development and reduced poverty rates.

Q17: How did the social status of black women in finance change over the years with Aura's support?

A17: The social status of black women improved as they became recognized as successful entrepreneurs and professionals, breaking stereotypes and gaining respect and influence within their communities.

Q18: What role did these women play in their local economies after gaining financial independence?

A18: These women played significant roles as business owners, employers, and community leaders, driving economic growth and fostering a spirit of entrepreneurship in their localities.

Q19: How has the initiative influenced the perception of black women in finance?

A19: The initiative has helped change perceptions by showcasing the capabilities and successes of black women in finance, challenging biases, and highlighting the importance of diversity and inclusion in the financial sector.

Q20: How many businesses were started by black women who participated in Aura's programs?

A20: Over the past 34 years, thousands of businesses have been started by black women who participated in Aura's programs, contributing significantly to local and national economies.

LONG-TERM EFFECTS AD CURRENT STATUS

Q21: How have Aura's programs evolved over the last 34 years?

A21: Aura's programs have evolved to include digital literacy, advanced financial technologies, and global market access, reflecting the changing economic landscape and needs of black women in finance.

Q22: What long-term effects have been observed among the program participants?

A22: Long-term effects include sustained financial independence, continued business growth, multi-generational impact on families, and the emergence of participants as community leaders and mentors.

Q23: How does Aura continue to support black women in finance today?

A23: Aura continues to support through ongoing training, access to financial resources, mentorship programs, and partnerships with other organizations to expand opportunities for black women in finance.

Q24: Are there any second-generation beneficiaries of these programs?

A24: Yes, many children of the original program participants have benefited indirectly through improved family financial stability and directly through involvement in new youth-focused initiatives launched by Aura.

Q25: How many black women have been reached by Aura's initiatives since 1990?

A25: Since 1990, Aura's initiatives have reached tens of thousands of black women, providing them with the tools and resources needed to achieve financial independence and professional success.

LEADERSHIP AND MENTORSHIP

Q26: How did Aura develop leadership skills among the women in their programs?

A26: Aura offered leadership development workshops, one-on-one coaching, and opportunities to lead community projects. This training helped participants build confidence and acquire the skills necessary for leadership roles.

Q27: What mentorship opportunities were provided to black women in finance by Aura?

A27: Participants were paired with experienced mentors from the financial industry who provided guidance, support, and networking opportunities. These mentors played a crucial role in helping the women navigate their careers and business ventures.

Q28: How have these women, in turn, become mentors to others?

A28: Many program alumni have become mentors themselves, giving back to their communities by guiding new participants and sharing their knowledge and experiences to inspire the next generation of black women in finance.

Q29: What role did mentorship play in the success of Aura's programs?

A29: Mentorship was pivotal in the success of Aura's programs as it provided participants with personalized support, professional connections, and practical advice, significantly enhancing their chances of success.

Q30: How did Aura facilitate networking opportunities for these women?

A30: Aura organized networking events, industry conferences, and community gatherings where participants could meet professionals, potential investors, and other entrepreneurs, thus expanding their professional networks.

Challenges and Overcoming Barriers

Q31: What were the biggest barriers faced by black women in finance before Aura's support?

A31: The biggest barriers included limited access to financial resources, lack of professional networks, systemic discrimination, and insufficient financial literacy and business training.

Q32: How did Aura help these women overcome these barriers?